401k to roth ira conversion calculator

Roth 401 k Conversion Calculator. Your income for the tax year will.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Say youre in the 22 tax bracket and convert 20000.

. This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account. Calculate your earnings and more. Converting to a Roth IRA may ultimately help you save money on income taxes.

Traditional vs Roth Calculator. A 401 k can be an effective retirement tool. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

Roth IRA Conversion Calculator Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Your IRA could decrease 2138 with a Roth. Colorful interactive simply The Best Financial Calculators. Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions.

Roth IRA Conversion Calculator - Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same funds in your. Protect Yourself From Inflation. IRA to Roth Conversion Calculator.

Ad Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips. It increases your income and you pay your ordinary tax rate on the conversion. The VeriPlan Roth IRA conversion calculator feature running on Microsoft Excel functions as a Roth IRA predictor enabling year-by-year Roth conversion analysis.

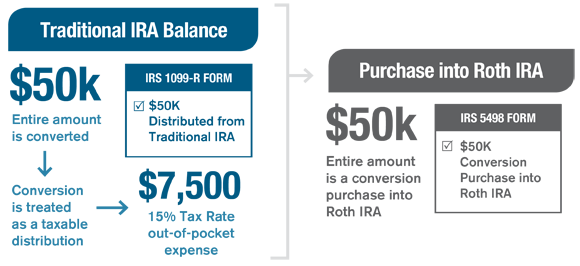

A Roth IRA conversion is a tool that allows individuals to convert money from a tax-deferred retirement account like a traditional IRA or 401k into a Roth IRA. 10 Best Companies to Rollover Your 401K into a Gold IRA. Roth IRA Conversion Calculator to Calculate Retirement Comparisons.

This places you in the 22 tax bracket. The information in this tool includes education to help you determine if converting your. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

For instance if you expect your income level to be lower in a particular year but increase again in later years. Use this Roth IRA conversion calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus. One big decision is whether or not you should convert your traditional IRA.

There are many factors to consider including the amount to convert current tax rate and your age. Visit The Official Edward Jones Site. With the passage of the.

Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well. The Roth 401 k allows contributions. Ad Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips.

Assume your taxable income is 50000 for 2020. If you are thinking about rolling over and are not sure what option is most financially beneficial we can help you. Once converted Roth IRA plans are not subject to required minimum distributions RMD.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. 401k IRA Rollover Calculator. Get a Roth 401 k Conversion Calculator branded for your website.

Discover The Answers You Need Here. Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions. If you were to contribute more than 34200 your tax rate will go up to 24.

Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Roth IRA Conversion Calculator. New Look At Your Financial Strategy.

This calculator will analyze your information and. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until. 401 k Rollover Calculator.

When planning for retirement there are a number of key decisions to make.

Download Roth Ira Calculator Excel Template Exceldatapro

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Roth Ira Conversion Calculator Converting An Ira Schwab Roth Ira Conversion Roth Ira Conversion Calculator

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Conversion Ira

How To Do A Backdoor Roth Ira Contribution Safely Roth Ira Contributions Roth Ira Roth Ira Conversion

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Pennies And The Backdoor Roth Ira The White Coat Investor Investing Personal Finance For Doctors Roth Ira Ira White Coat Investor

Converting Your Traditional Ira Janus Henderson Investors

Roth Ira Conversion Ameriprise Financial

Traditional Vs Roth Ira Calculator

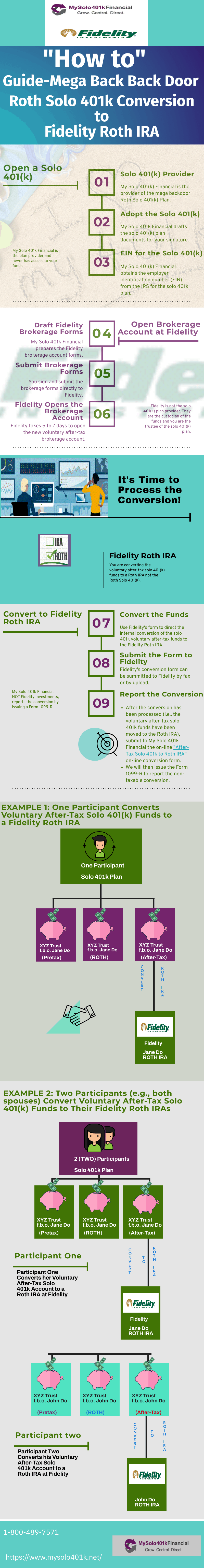

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Over The Roth Ira Income Limit Considering A Backdo Ticker Tape

Roth Ira Calculator Roth Ira Contribution